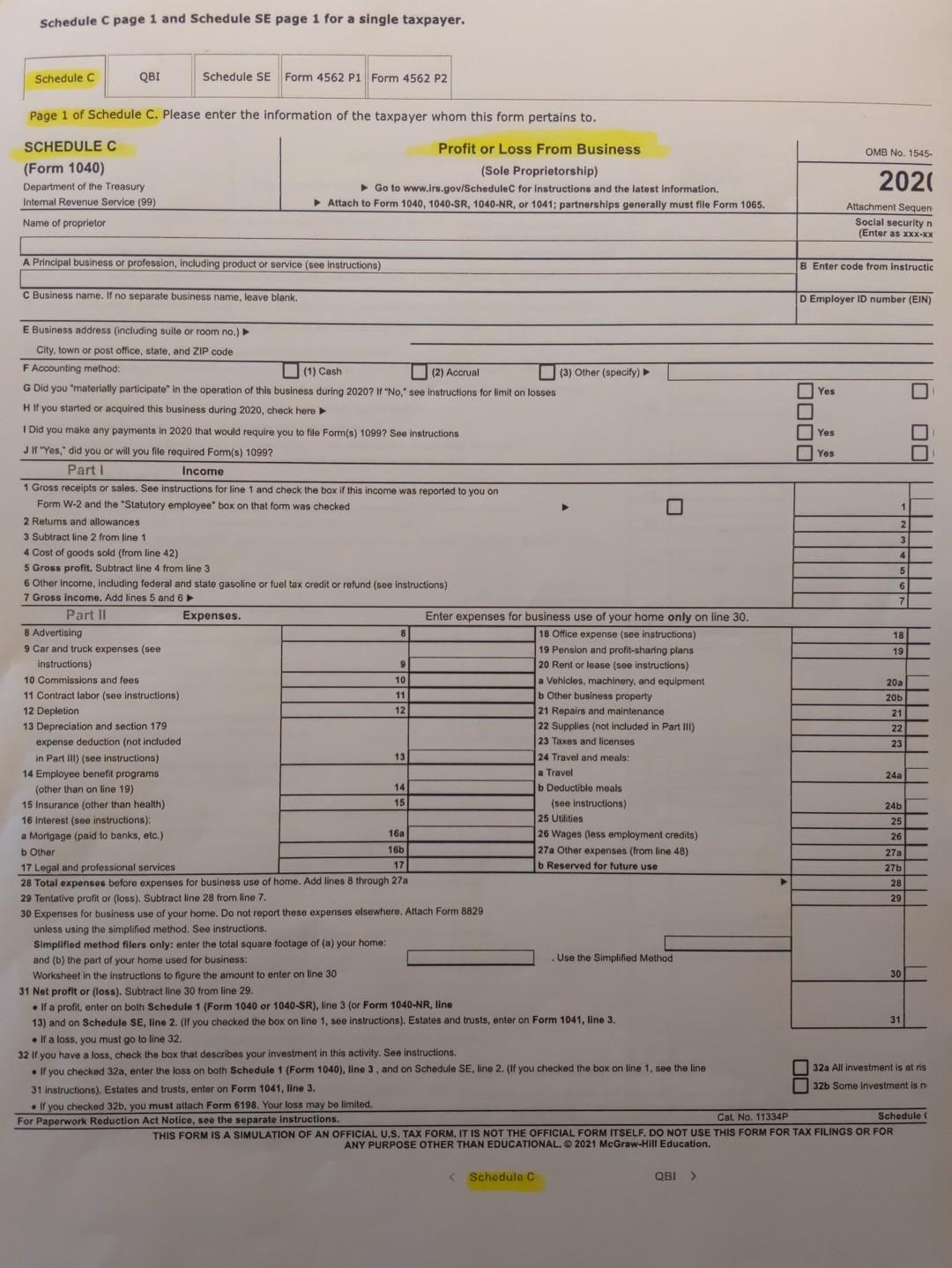

schedule c tax form 2020

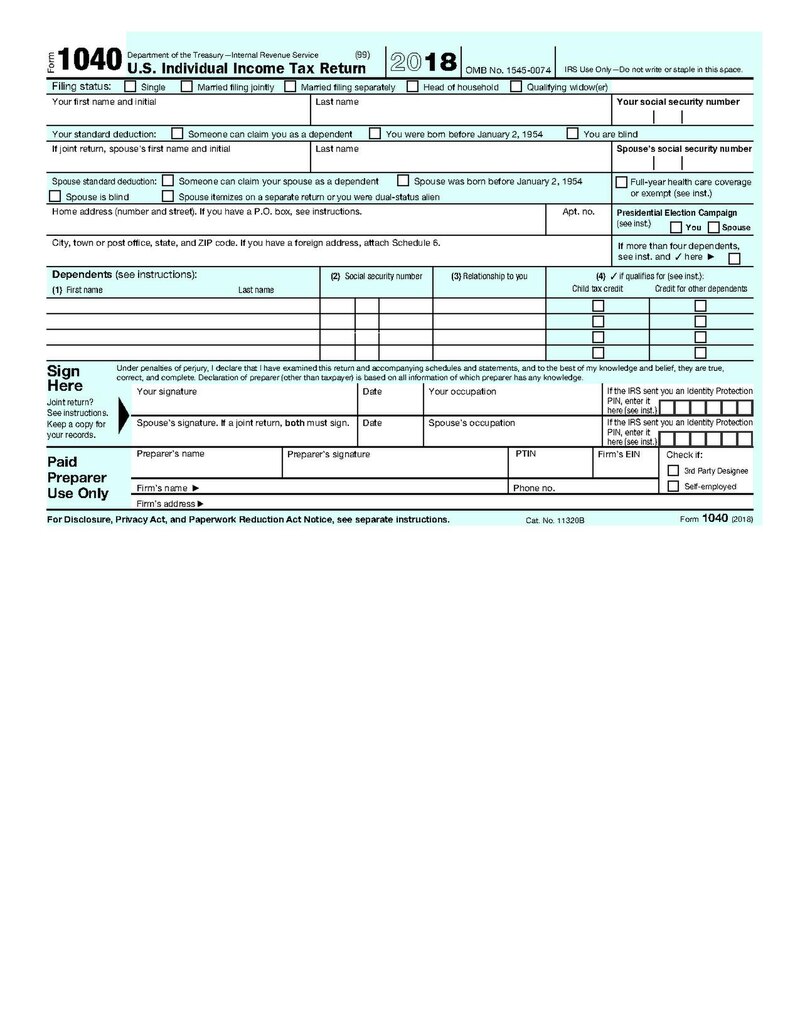

Prepare and eFile your IRS and state current year tax return s by April 15 following a given tax year. Form 1120-C Department of the Treasury Internal Revenue Service US.

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

DR 0112RF - Receipts Factor Apportionment Schedule.

. DR 0158-C - Extension of Time for Filing a Colorado C Corporation Income Tax. 26 rows Form 1040 Schedule C Profit or Loss from Business Sole Proprietorship 2020 Inst. Residency in 2020 you must file Form 8854 Initial and Annual Expatriation Statement with your 2020 income tax return.

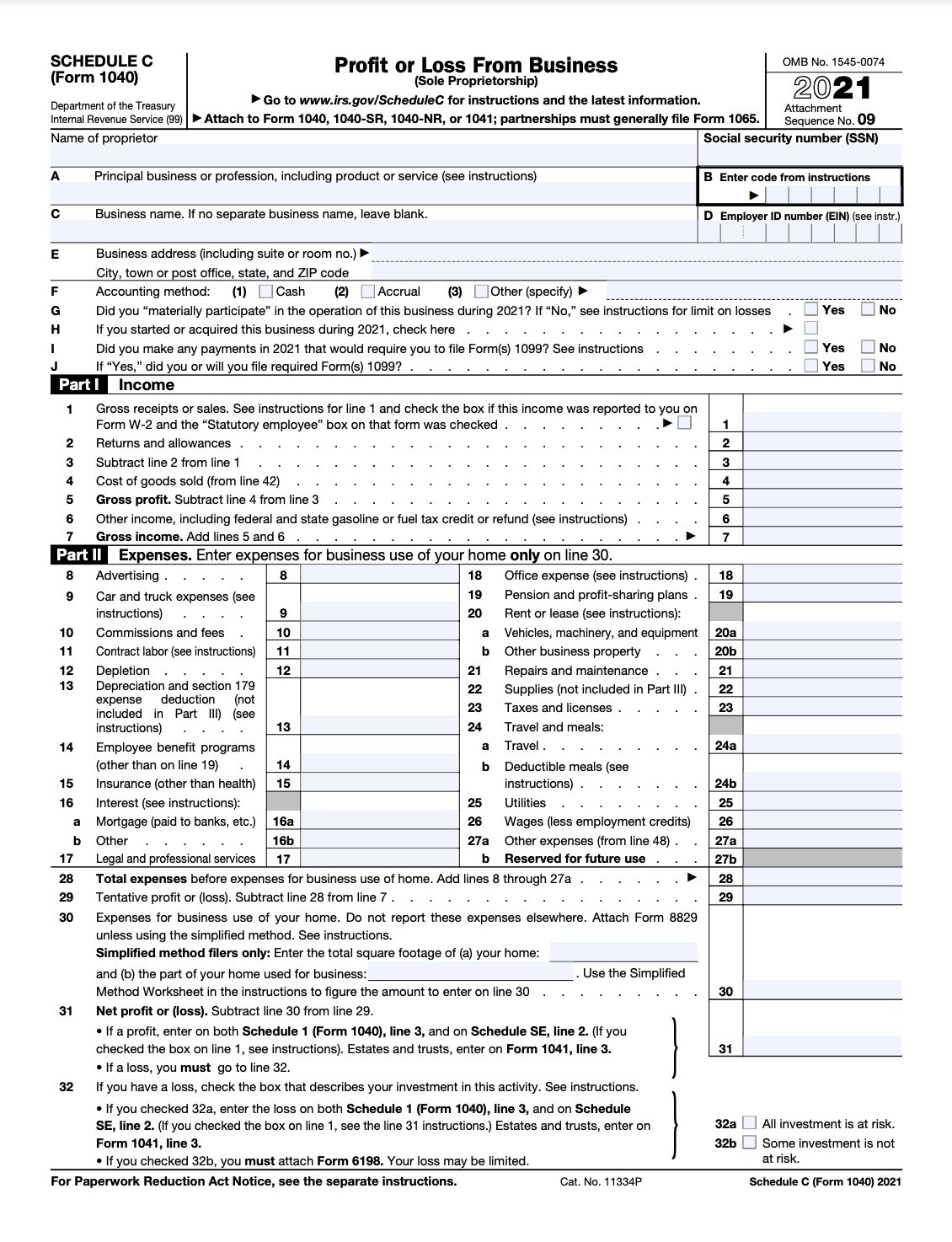

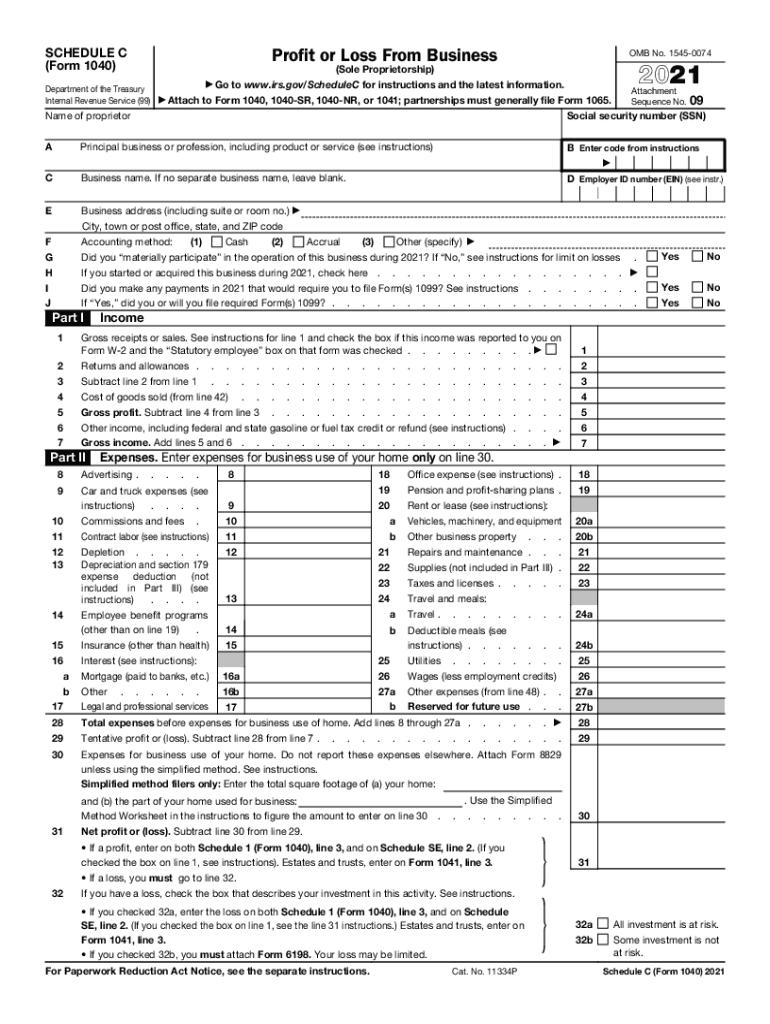

Schedule C is typically for people who operate sole proprietorships or single-member LLCs. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Printable Form 1040 Schedule C.

An activity qualifies as a business if your. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and. DR 0112X - Amended Return for C Corporations.

Profit or Loss From Business Sole Proprietorship is used to report how much money you made or lost in a business you operated by yourself. These free PDF files are. 2020 Instructions for Schedule CProfit or Loss From Business Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole.

Income Tax Return for Cooperative Associations For calendar year 2020 or tax year beginning 2020 ending 20. 9 rows Form 1040 Schedule C Profit or Loss from Business Sole Proprietorship 2022. Known as a Profit or Loss From Business form it is used to.

LAST NAME SOCIAL SECURITY NUMBER OF PROPRIETOR BUSINESS NAME EMPLOYER IDENTIFICATION. The resulting profit or loss is typically. If you miss this deadline and did not e-file a tax extension you have until.

A Schedule C is not the same as a 1099 form though you may need IRS Form. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and the. SCHEDULE C Form 1040 Department of the Treasury Internal Revenue Service 99 Profit or Loss From Business Sole Proprietorship Go to wwwirsgovScheduleC for instructions and.

You also may be subject to income tax under section 877A on the net. Click any of the IRS Schedule C form links below to download save view and print the file for the corresponding year. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business.

A Schedule C Form is a supplemental form that is sent with a 1040 when someone is a sole proprietor. The form reports how. Massachusetts Profit or Loss from Business.

How Ppp Loan Forgiveness Works For The Self Employed Bench Accounting

Solved Where Would I Find My Schedule C

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

What Is Tax Form 1040 Schedule C The Dough Roller

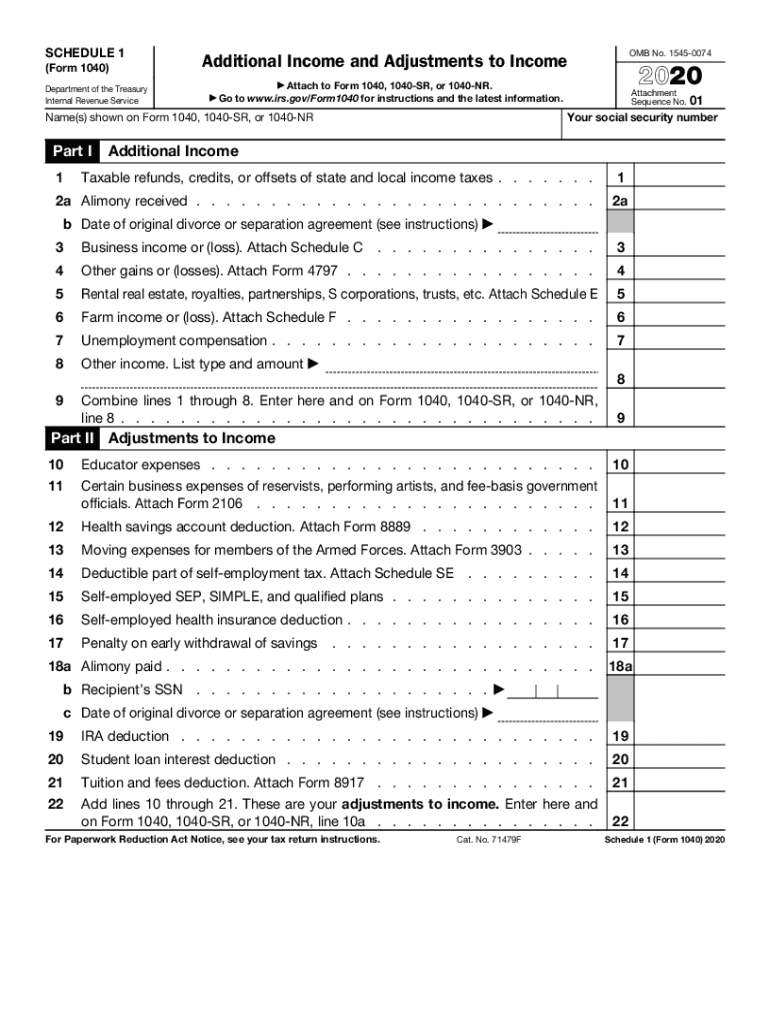

2021 Schedule 1 Form And Instructions Form 1040

2021 Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

Business Activity Code For Taxes Fundsnet

Solved Cassi Ssn 412 34 5670 Has A Cash Basis Home Chegg Com

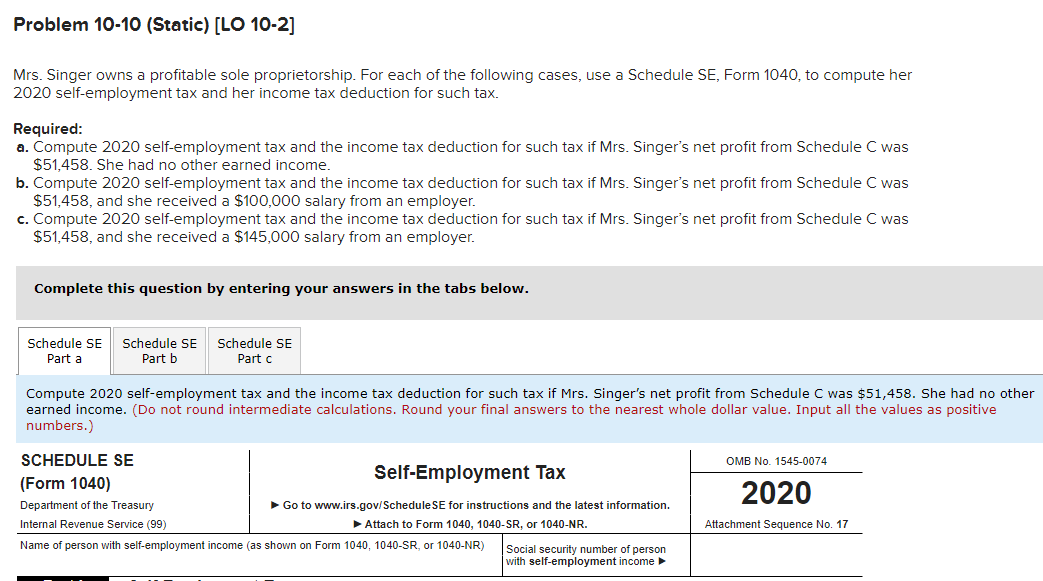

Problem 10 10 Static Lo 10 2 Mrs Singer Owns A Chegg Com

Solved Income Tax Return Problem Only Prepare Schedule C With The Detail Course Hero

Schedule C Form 1040 Free Fillable Form Pdf Sample Formswift

How To Complete Your Schedule C Tax Form Everlance

Schedule C Form 1040 Tax Return Preparation By Businessaccountant Com Youtube

2020 Form Irs 1040 Schedule 1 Fill Online Printable Fillable Blank Pdffiller

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

The Ultimate Tax Guide Know Your Tax Forms Schedule E

Tutorial Crypto Taxes For Beginners

Schedule A Form 1040 A Guide To The Itemized Deduction Bench Accounting